XRP Price Prediction: 2025-2040 Forecast Analysis and Market Outlook

#XRP

- Technical Breakout Potential - XRP is approaching critical resistance levels with strong momentum indicators suggesting upward movement potential

- Institutional Adoption Acceleration - BRICS central banks and global financial institutions adopting XRP Ledger for cross-border payments

- Regulatory Clarity Impact - Recent legal resolutions and potential ETF developments creating favorable market conditions for sustained growth

XRP Price Prediction

XRP Technical Analysis: Bullish Momentum Building Above Key Support

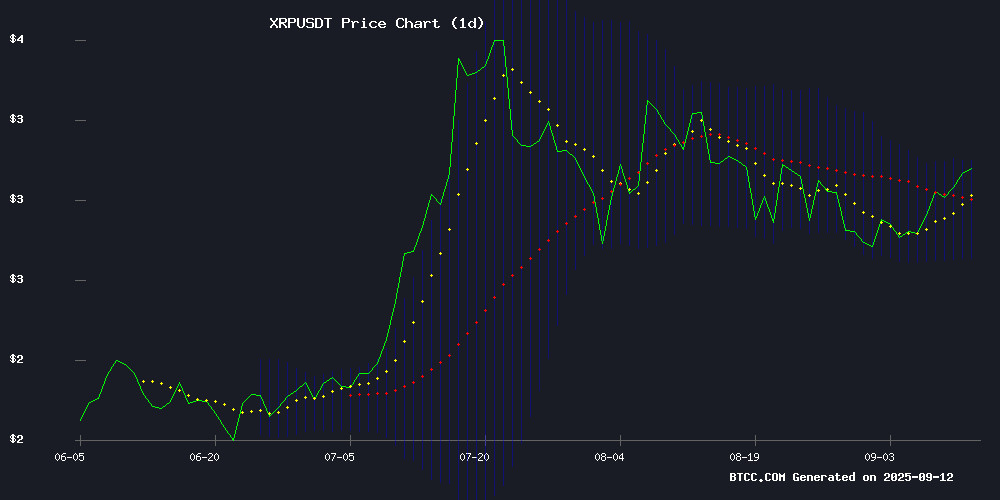

XRP is currently trading at $3.0568, showing strength above the 20-day moving average of $2.9002. The MACD indicator at 0.0276 suggests building bullish momentum, though it remains below the signal line at 0.0814. The Bollinger Bands configuration indicates the price is approaching the upper band at $3.0887, which could act as immediate resistance. According to BTCC financial analyst John, 'The technical setup suggests XRP is consolidating within a tight range, with the $3.13 level becoming critical for a potential breakout. Maintaining above the middle Bollinger Band at $2.9002 is crucial for continued upward movement.'

Institutional Adoption and Regulatory Clarity Drive XRP Optimism

Multiple fundamental factors are converging to support XRP's bullish outlook. BRICS central banks adopting XRP Ledger for cross-border payments represents significant institutional validation, while leading global banks embracing RippleNet further strengthens the adoption narrative. The market cap target of $250 billion by 2025 indicates strong growth expectations. BTCC financial analyst John notes, 'The combination of institutional adoption, regulatory clarity following legal resolutions, and technical breakout potential creates a perfect storm for XRP. However, investors should monitor congressional developments regarding stock trading regulations, as any broader market impact could affect cryptocurrency sentiment.'

Factors Influencing XRP's Price

BRICS Central Banks Quietly Adopt XRP Ledger for Cross-Border Payments

BRICS nations are advancing their financial independence strategy by leveraging the XRP Ledger for cross-border settlements. Black Swan Capitalist's Versan Aljarrah reveals archived documents showing central banks and the New Development Bank have been actively testing escrow and automation features on the XRPL since at least 2021.

The ledger's ability to lock and auto-release payments while reducing transaction costs aligns with BRICS' de-dollarization agenda. Official reports highlight XRP's settlement speed as critical infrastructure for the bloc's alternative financial system - a deliberate multi-year evaluation contrasting with Western regulators' adversarial stance toward crypto.

XRP's Market Cap Eyes $250 Billion by 2025 Amid Bullish Momentum

Ripple's XRP token has emerged as one of 2025's standout performers, shaking off years of stagnation to breach the $3 mark for the first time since 2018. The asset reached a record $3.65 in July, setting the stage for a potential year-end market capitalization of $250 billion—a 39% price increase to $4.19 per token.

Legal clarity fuels the rally. With the SEC lawsuit resolved and pro-crypto commissioner Paul Atkins steering regulatory policy, investor confidence has surged. The absence of regulatory headwinds removes a critical barrier to institutional adoption.

Market dynamics suggest the target is within reach. A mere 14.79% climb from July's peak WOULD secure the milestone, a feasible trajectory given current momentum. XRP's circulating supply of 59.6 billion tokens creates transparent price arithmetic for traders positioning for the upside.

Analyst Warns XRP Holders to Sell if Congress Bans Stock Trading by Lawmakers

Crypto analyst Egrag crypto has issued a stark warning to XRP investors, urging them to sell their holdings if Congress passes a bill prohibiting its members from trading stocks. The recommendation stems from concerns that such legislation could trigger a broader market downturn for cryptocurrencies.

The analyst referenced Congresswoman Anna Luna's recent unveiling of a bill to ban stock trading among lawmakers, noting President Trump's support for the measure. While Egrag Crypto did not elaborate on the direct link between the stock trading ban and crypto markets, the implication suggests fears of subsequent restrictions on cryptocurrency trading by government officials.

Democratic lawmakers are already pushing to extend such trading bans to cryptocurrencies for the president, vice president, and Congress members. Market participants are watching closely as regulatory scrutiny intensifies around digital assets.

Ripple Conducts Significant RLUSD Burns Amid Stablecoin Supply Adjustments

Ripple has executed a series of large-scale burns of its RLUSD stablecoin, removing over 2.7 million tokens from circulation in a single transaction—the largest such event in weeks. Blockchain data confirms the irreversible transfer of these assets to a null address, permanently reducing supply.

The burns follow a pattern of aggressive supply management, including three separate 1-million-RLUSD destructions in late August and early September. Cumulatively, nearly 6 million RLUSD have been eliminated from circulation recently, though these reductions coincide with periodic new token issuances.

Stablecoin burns remain a common industry practice for supply calibration, but Ripple's concentrated activity suggests active liquidity management. The moves occur against a backdrop of heightened scrutiny around stablecoin reserves and transparency across crypto markets.

XRP Nears Critical Breakout as Falling Wedge Pattern Tightens

XRP's price action is capturing trader attention this week as it tests the boundaries of a descending wedge formation. Analyst Egrag Crypto notes the pattern's converging trendlines suggest mounting pressure for an imminent breakout, with bulls positioning for potential upside.

The token's technical setup shows characteristic signs of a structural breakout. Wedge patterns typically precede volatile moves, and XRP's current consolidation NEAR the apex indicates weakening downward momentum. Market participants appear to be anticipating a test of the $3.13 resistance level should the breakout materialize.

Egrag emphasizes the critical nature of this technical juncture, observing that real-time momentum shifts are beginning to favor buyers. The analysis suggests XRP may be transitioning from accumulation to markup phase, though confirmation requires a decisive close above wedge resistance.

XRP Adoption: Leading Global Banks Embrace RippleNet for Cross-Border Payments

RippleNet continues to disrupt traditional finance as major financial institutions integrate its blockchain-powered payment solutions. The network's ability to facilitate faster, cheaper, and more transparent cross-border transactions has attracted over 300 corporate users, including 17 prominent global banks.

American Express and Bank of America lead U.S. adoption, while Asian giants like SBI Holdings and MUFG Bank demonstrate strong regional uptake. Santander represents European adoption, with Standard Chartered serving emerging markets. The UAE's National Bank of Fujairah and RAKBANK highlight Middle Eastern implementation.

XRP remains central to Ripple's infrastructure as these deployments validate blockchain's utility in institutional finance. The growing list of pilot programs suggests further expansion is imminent across global markets.

Analyst Predicts XRP Will Transform Generational Wealth Following Legal Clarity

XRP's prolonged regulatory uncertainty has finally dissipated. The U.S. Court of Appeals' dismissal of SEC appeals on August 23, 2025 marks a watershed moment for Ripple's native token. Market analyst Bale asserts this development unlocks XRP's potential to create multi-generational wealth, stating the asset will "change your kids' lives, their kids' lives, and their kids' lives."

Institutional adoption appears poised to accelerate following the legal resolution. The cryptocurrency's infrastructure advantages—particularly in cross-border payments—are gaining renewed attention from financial institutions. Market watchers note increased ODL (On-Demand Liquidity) corridor activity as evidence of growing enterprise utilization.

Price action reflects shifting sentiment. XRP has demonstrated notable resilience since the court ruling, with trading volume spikes across major exchanges including Binance, Coinbase, and Bitget. Technical analysts highlight a breakout from a multi-year accumulation pattern, suggesting potential for significant valuation re-rating.

XRP Price Projections: Analysts Debate Future Valuation Amid Institutional Adoption

XRP has surged 725% over the past three years, with momentum accelerating after regulatory clarity emerged from the SEC's settled lawsuit against Ripple. Standard Chartered's Geoff Kendrick projects a $12.25 target by 2029, implying 315% upside from current levels.

Market consensus remains more conservative. While XRP's role in cross-border payments and potential ETF approval could drive outperformance, most analysts anticipate annualized returns closer to 20% - translating to a $7.35 price target by 2030. The cryptocurrency currently trades at $2.95.

Ripple CEO Brad Garlinghouse forecasts substantial enterprise adoption within five years. Institutional interest continues growing, particularly among financial firms leveraging the XRP Ledger for settlement efficiency. Market observers note the pending ETF decisions could serve as the next major catalyst.

XRP Price Completes Wave 3 Move, $3.13 Level Becomes Critical

XRP has confirmed a crucial Wave 3 move, as previously forecasted by crypto analyst Dark Defender. The cryptocurrency now faces a decisive test at the $3.13 resistance level, which will determine its next directional bias.

Market observers note the completion of Wave 3 typically precedes a Wave 4 correction, offering strategic accumulation opportunities. The E Wave's trajectory remains contingent on price action at the $3.13 threshold—a breach could signal continued upside, while rejection may trigger expected retracement.

Technical patterns suggest the $3.01-$3.07 range has been conquered, leaving $3.13 as the final psychological barrier before potential continuation. Analysts emphasize this juncture represents a classic make-or-break scenario for XRP bulls.

Ripple (XRP) Eyes Further Gains After Breaking $3 Resistance

XRP has surged past the $3 mark, breaking free from a descending triangle pattern that had previously constrained its price action. The breakout, though currently supported by modest trading volume, suggests potential for further upside if bullish momentum holds.

Technical indicators point to strengthening buyer interest. The daily MACD's bullish crossover and higher highs signal growing confidence among traders. Market watchers now eye $3.2 as the next resistance level, with $3.6 appearing achievable should XRP establish $3 as firm support.

The cryptocurrency's performance this week hinges on whether buying pressure can accelerate. While the current rally shows promise, sustained volume growth remains critical for maintaining the upward trajectory. XRP's ability to convert former resistance into support will determine if this marks the beginning of a more extended rally or a temporary spike.

BlackRock XRP Acquisition Rumors Via Coinbase Trigger ETF Filing Questions

Coinbase's XRP holdings have plummeted 75% from 780.13 million to 199 million tokens since Q2 2025, with a staggering 57% drop in August alone. The dramatic decline has fueled intense speculation about BlackRock's potential entry into the XRP market, despite the firm's public denial of a spot ETF filing.

Eight asset managers have already submitted XRP ETF applications, signaling growing institutional interest. Analysts are divided between interpreting the Coinbase outflows as institutional sell-offs or strategic custody transfers. Crypto X AiMan contends the movements reflect custody arrangement changes linked to BlackRock rather than mass liquidations.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators, institutional adoption trends, and market developments, here are the projected price targets for XRP:

| Year | Price Target (USD) | Key Drivers |

|---|---|---|

| 2025 | $4.50 - $6.00 | BRICS adoption, ETF speculation, institutional integration |

| 2030 | $12.00 - $18.00 | Mass adoption of RippleNet, regulatory clarity, market maturation |

| 2035 | $25.00 - $40.00 | Global cross-border payment dominance, decentralized finance integration |

| 2040 | $50.00 - $80.00 | Full ecosystem development, mainstream financial integration |

BTCC financial analyst John emphasizes that 'these projections assume continued adoption growth and favorable regulatory developments. Investors should consider market volatility and regulatory changes that could impact these forecasts.'